Abstract

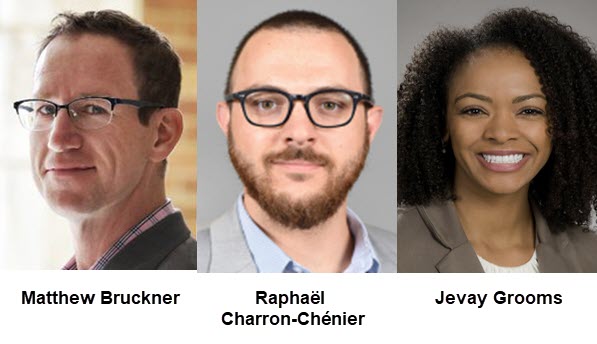

Excerpted From: Matthew Bruckner, Raphaël Charron-Chénier, and Jevay Grooms, Bankruptcy in Black and White: the Effect of Race and Bankruptcy Code Exemptions on Wealth, 28 Michigan Journal of Race and Law 217 (Fall, 2023) (179 Footnotes) (Full Document)

In the United States, debtor-creditor laws produce racially disparate outcomes despite being facially race neutral. Exemption laws are no different. This Article is among the first to examine the racially disparate results of applying race-neutral exemption laws in bankruptcy, results anticipated by Professor Mechele Dickerson in two ground-breaking articles on how race matters to bankruptcy law.

In the United States, debtor-creditor laws produce racially disparate outcomes despite being facially race neutral. Exemption laws are no different. This Article is among the first to examine the racially disparate results of applying race-neutral exemption laws in bankruptcy, results anticipated by Professor Mechele Dickerson in two ground-breaking articles on how race matters to bankruptcy law.

Among other results, we find that exemption laws advantage white debtors relative to Black debtors by allowing homeowners and holders of certain personal property to retain some or all their equity in those assets when they exit bankruptcy. Some of these racial differences might be explained by higher asset values at the time white and Black debtors enter bankruptcy. For example, white debtors tend to have more equity in their homes when they enter bankruptcy and so they leave bankruptcy with substantially more home equity than Black debtors. However, white debtors in our sample retain a larger percentage of their motor vehicles' value than Black debtors despite reporting lower values of this type of personal property when they filed bankruptcy. In these ways, exemption laws appear to aid white debtors over Black debtors in retaining wealth post-bankruptcy.

In her earlier work, Professor Mechele Dickerson argued that bankruptcy law favors certain white debtors over debtors from other racial groups by, among other things, allowing debtors to retain their equity in assets that white debtors are more likely to own. This Article provides some of the first empirical evidence for Professor Dickerson's theory by examining the role that exemptions (the method for providing preferential treatment to certain assets in bankruptcy) play in perpetuating or increasing wealth inequality across Black and white Americans. This Article details the frequency and value of real and personal property ownership in bankruptcy for residents of Washington, D.C. in 2011, including homes, vehicles, retirement accounts, apparel, jewelry, cash and cash equivalents, and other household goods. The first two--houses and cars--turn out to be the most important.

This Article offers two primary contributions. First, we created a new dataset based on a random sample of bankruptcy petitions drawn from the United States Bankruptcy Court for the District of Columbia, all of which were filed in 2011. This dataset will be made available to other researchers in the future. Second, we describe and quantify racial disparities in bankruptcy cases that exist despite our facially neutral exemption laws.

The remainder of the Article proceeds as follows. In Section I, we provide some background, both on the racial wealth gap and on the relevant existing literature. In Section II, we provide an overview of consumer bankruptcy law with a focus on the distinctions between chapter 7 and chapter 13. In Section III, we provide our data analysis, including a separate analysis for real and personal property. The most important personal property categories are vehicles and retirement accounts. A conclusion follows. Additional tables are available in Appendix A, and Appendix B provides additional details about our dataset, including its limitations and how we estimated the racial identity of debtors in our sample.

[. . .]

Given the richness of our data relative to other available bankruptcy datasets--in particular, our ability to examine assets and exemptions both in the aggregate and for particular categories of goods and services--our primary aim in this project is to provide a descriptive overview of petitions for D.C. residents who filed for bankruptcy in 2011. Our conclusions, however, are limited to this particular sample. We avoid overarching claims about D.C. bankruptcies in other years or bankruptcies in other jurisdictions.

Bankruptcy petitions suffer from occasional missing data issues. Filers occasionally leave off some information requested by bankruptcy forms. Generally, we treat blank entries as a missing value, and therefore exclude these data points from the specific estimates that would make use of them (i.e., we use pairwise rather than listwise deletion). To help readers understand where missing cases were excluded, we report sample sizes used for different estimates; see, for example, Table A3 in Appendix A. For some specific estimates from Schedules B and C, blank entries on petitions are generally used to indicate the absence of an asset or the failure to claim an exemption. For these schedules, we coded blank entries as valid zeros. If some entries were left blank as an oversight rather than to indicate lack of assets or exemptions, this could potentially bias our estimates downward.

Bankruptcy filers are likely to commit some errors and omissions (involuntary or otherwise) when preparing their petitions. As bankruptcy cases move forward, these errors or omissions may be corrected. These corrections, however, may not be reflected in our data. Such entry errors by the original petitioner may account for slight discrepancies we observed across some estimates. Given our limited sample size, we opted not to drop petitioners with inconsistent answer patterns. Instead, we indicate via footnote whenever an apparent data discrepancy arises because of likely filer error and, where possible, exclude that data point from relevant analyses. Given the legal ramifications of dissimulating information on these petitions, we believe most errors are unintentional. Given the incentives filers have to report correctly and the large number of filers with bankruptcy counsel, we also believe errors are likely limited in numbers.

Valuable support was provided by the Society of Actuaries (“SOA”), who funded our data collection effort. Members of the SOA Project Oversight Group, including Brian Bayerle, Patrick Fillmore, Robert M. Gomez (chair), Andrew Melnyk, Colin M. Ramsay, Anna M. Rappaport, and John W. Robinson, provided valuable insights and comments on several earlier drafts. Lisa S. Schilling also provided extensive feedback on several earlier drafts.